Director of Sales

Crypto Compliance in 2024

Crypto compliance in 2024 is evolving as the laws regulating markets are being drafted and enacted around the world. In this article, we explore why crypto regulation is changing and how you can position your company to be victorious through proactive preparation and lightweight solutions.

Why Are Regulations Changing?

You’ve heard crypto referenced as “the future of money” because the concept of value transfer is more efficient in an open network than a closed system, with proprietary platform constraints. In order to upgrade the current system, it requires less entropy and greater consistency. However, existing governments and financial institutions are inherently intermediaries that require command and control platform paradigms. Undoubtedly, governments, and regulators, care when and where “money” is moving. Yet, web3 builders don’t want innovation to be stifled by bureaucracy. How do we merge closed platforms (web2) and accessible open source networks (web3) when it comes to compliance in 2024?

Both paradigms have and continue to make concessions in order to create a future that enhances speed, transparency, security, and abundance. In order to merge systems, our obligation as innovators is to find opportunity on common ground. Creating opportunity through compliance, means you outperform your competitors. The most important solutions being considered by the next generation of both protocol builders and lawmakers are happening today, and CUBE3 provides tools helping both achieve their goals.

The ETF Concession — Crypto is Here to Stay

When the SEC approved the bitcoin ETF on January 10 of this year, it signaled the first legitimate establishment concession that crypto is here to stay. A week after approval, Coindesk reported:

“Bitcoin ETFs had more assets than silver ETFs the instant the U.S. Securities and Exchange Commission approved them last week, and trailed only gold among commodity-focused U.S. ETFs.”

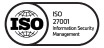

Bitcoin is 15 years old, while silver has been an asset for about 5,000 years. At the time of writing, the AUM of the 11 approved Bitcoin ETFs was about 30 billion in less than 4 weeks of trading. The winners (like Grayscale) prepared early and baked risk into their process, the GBTC results are clear:

What Can DeFi Learn from Tradfi?

TradFi winners like Grayscale, Blackrock and ARK are winning because they prepared for regulatory oversight. They took a calculated risk that perhaps the SEC would not create clear regulation for them to operate. Conversely, web3 builders will win when they take risk regulators will implement clear regulation. With US Treasury Secretary Janet Yellen calling for Congress to pass crypto regulation and recognizing not all cryptocurrencies are securities, proactive preparation is the most prudent:

What is MiCA?

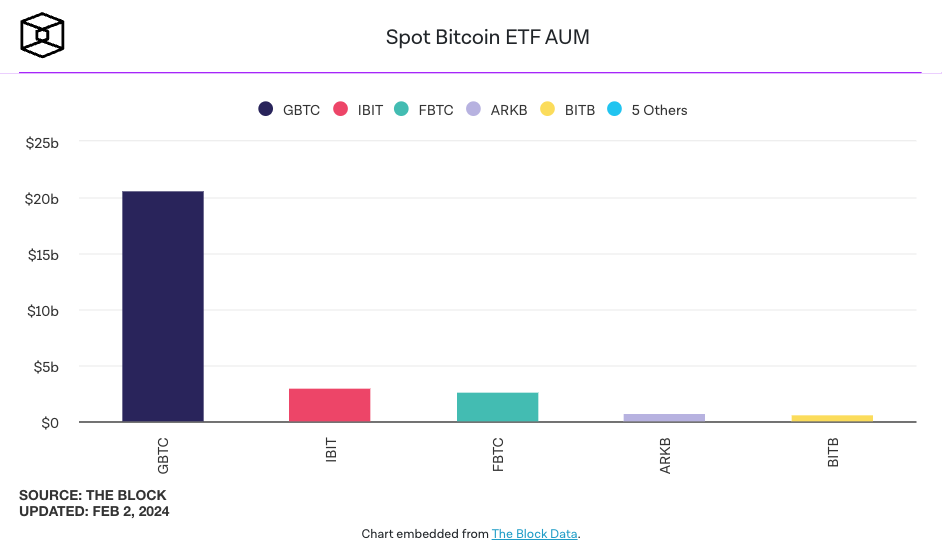

Similar to privacy legislation like GDPR, the US has waited to see the EU test regulatory oversight in crypto markets. Until the US Congress approves any clear guidance, the EU’s Markets in Crypto-Assets (MiCA) will be the first multinational crypto regulation to directly influence companies. Here’s an overview of changes happening in the EU and how you can use lightweight tools that let you build to win.

MiCA Overview – 6 things to know

The EU crypto industry has been broadly supportive of MiCA, but the potential costs of not meeting standards are high. Those deemed noncompliant potentially face million-euro penalties that could be as high as 12.5% of annual turnover.

- MiCA applies as of Dec. 30, 2024, with stablecoin provisions taking effect in June.

- Crypto-asset service providers (CASP) will need to obtain a license to operate within the EU. Including exchanges, wallet providers, and other crypto-related services. Companies already operating may need to adjust their compliance operations.

- CASPs will need to apply customer due diligence measures when carrying out transactions amounting to about €1000 or more.

- Enhanced due diligence measures for cross-border correspondent relationships for CASPs.

- Stricter Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, monitoring transactions, reporting.

- Regular audits and compliance checks could become the norm.

CUBE3’s Ready to Use MiCA Tools

- Customers can use CUBE3 to detect suspicious wallets transacting with their applications

- With CUBE3, customers can get additional data points on risky addresses (hackers, fraudsters, etc)

- CUBE3 products are highly modular and customizable

- CUBE3 provides fast and easy to integration

- We have four ways to integrate and provide data:

- API

- Monitor product (solving for #5 and #6 above)

- SDK for front-end application – detect and block.

- Blocking at the smart-contract level – detect and block.

Lastly, CUBE3 can inject customer KYC data, including their own blacklists and/or 3rd party feeds if customers want those driving our Blocking capabilities.

Compliance Preparation Mints Winners

Let’s take a look at two web3 leaders with different levels of compliance perspectives that still maintain leadership in the industry: Coinbase and ShapeShift.

- Coinbase

- Embraced Licenses Regulation Early: Secured the first BitLicense from the NY Department of Financial Services in 2017

- Rigorous Asset Listing Process: Analyzing potential regulatory risks, sanctions concerns, and money laundering/terrorist financing associations

- Robust Tools and Personnel to Combat Illicit Activity: Expert team focused on KYC/AML checks, sanctions screening, and suspicious activity monitoring

- Commitment to Customer Education and Protection: Implements robust cybersecurity measures and Learn program to educate and protect users

One thing we can learn from Coinbase: Start earlier and leverage tools that ensure compliance.

- Shapeshift

Even the staunchest of crypto libertarians have made concessions and recognized the value of compliance. For example, Erik Voorhees has always contended less governmental involvement creates ideal circumstances for financial freedoms globally. Even as early as 2018, his flagship project Shapeshift, began releasing reports on their compliance cooperation efforts with law enforcement agencies. He also took proactive steps (without regulatory pressure) to reduce legal risk by requiring customer identities. Since then, Shapeshift has taken innovative steps to be an entirely decentralized company.

These companies paved the way before the term “web3” even began. Today, it’s easier than ever to get your compliance strategy right…

Your Choice: Crypto Winters or Crypto Winners

Some have already embraced the value of compliance and regulatory transparency. Others will see it as a chore and against the code-is-law ethos. Regardless of where you land on that spectrum, customers will be able to tell the difference and your project, services and even developers can suffer consequences if you ignore the risks of the current command and control systems. For example, even if you believe Tornado Cash is just a protocol, the reality is it is sanctioned by the United States. One of their developers is still awaiting trial after his arrest in Amsterdam.

Winners will harness compliance and lean in to build trust. No one wins when criminals use your protocols; counterproductive for the health of the web3 industry and the wrong thing to do, morally. As CUBE3’s CEO Einaras noted during a recent discussion:

“Bakeries don’t want mobsters buying their bagels. It’s bad for business. If I’m a business and I’m serving criminals, it’s just a matter of time before the FBI is at my door.”

Coinbase is the obvious example that took the long approach, starting early and engaging with regulators. Conversely, FTX was the wolf in sheep’s clothing that tried to pull the wool over the SEC’s eyes. Even so, just about a year after the fallout of Bankman-Fried, the SEC still approved the Bitcoin ETF. There is an equilibrium to be found.

Conclusion

As DeFi and web3 evolve, compliance with emerging regulations is crucial. Both protocol builders and governments are making concessions, while confirming regulatory oversight is inevitable. Despite having differing views on how to enact compliance, the bottom line is clear: ignoring regulatory risks can lead to severe consequences. As we approach the MiCA deadline, there’s no better time than now to act. Don’t let compliance concerns hinder your project’s success. If you need help or guidance, we’d love to connect.

In the US, there is a reaction that is doing what it can to reign in a future they can see but can’t quite capture. In the EU, they are in dangerous territory of trying to make laws so onerous they drastically reduce the possibility of law-abiding projects even being compliant. There is a middle ground, and it starts with awareness of what is available today and what is possible tomorrow.

All the more reason to build in safety mechanisms for your business and project. Security and compliance is a prerequisite. Learn from the best projects and take the proactive approach. Major projects are cooperating while staying close to their values and continue to be relevant.

CUBE 3 is here to help. Contact us, review our docs and access our free tools by signing up and joining our community today!

Tamás Kelemen

Tamás Kelemen

Attila Marosi-Bauer

Attila Marosi-Bauer

Silur

Silur

Sarunas Matulevicius

Sarunas Matulevicius

Einaras Gravrock

Einaras Gravrock

CUBE3.AI

CUBE3.AI