Content

Preparing for MiCA and AMLD Compliance: What Crypto Providers Need to Know

Introduction: Navigating MiCA and AMLD Requirements with Confidence

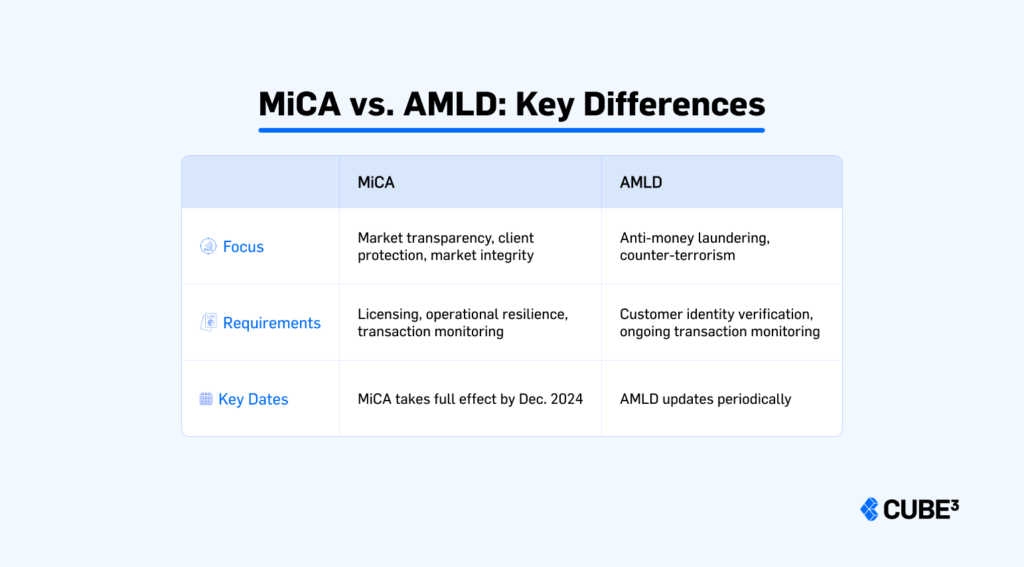

As the crypto landscape matures, regulatory standards like the Markets in Crypto-Assets (MiCA) and the Anti-Money Laundering Directive (AMLD) in the European Union are becoming central to compliance requirements for crypto-asset service providers (CASPs). These regulations are designed to increase market transparency, protect clients, and curb financial crimes in the crypto space.

For crypto-asset businesses, understanding these requirements is essential—not just to avoid fines but also to build a strong, trustworthy brand. CUBE3.AI offers advanced fraud prevention tools that support CASPs in meeting these obligations by proactively identifying and preventing fraud.

For a detailed overview on how MiCA impacts specific CASP types—like exchanges, custodians, and ICO issuers—read our in-depth MiCA guide here.

Understanding MiCA vs. AMLD: What’s Required?

What is MiCA?

The Markets in Crypto-Assets (MiCA) regulation is the first comprehensive framework aimed at regulating crypto assets across the EU. It covers licensing requirements for CASPs, transaction transparency, client protection, and operational resilience, including reliable governance practices that encompass aspects of security.

Key Points Under MiCA

- Client Protection (Best Interest Obligation): MiCA requires CASPs to act in the best interests of their clients by proactively addressing risks, including fraud and cyber threats. CASPs must protect clients from foreseeable risks, emphasizing transparency and accountability.

- Operational Requirements: MiCA mandates that CASPs follow strict standards for transaction transparency and record-keeping.

- Cybersecurity and Market Integrity: Ensuring that crypto platforms maintain resilience against fraud and manipulation is a core aspect of MiCA.

For a thorough exploration of how MiCA impacts different CASP types, including exchanges, custodians, ICO issuers, and more, refer to our MiCA guide.

What is AMLD?

The Anti-Money Laundering Directive (AMLD), specifically tailored for financial institutions, includes CASPs in its scope as well. AMLD focuses on reducing illicit activities like money laundering and terrorist financing. Unlike MiCA, which targets client protection and transparency, AMLD emphasizes due diligence, reporting, and the detection of suspicious activities.

Key Areas Under AMLD

- Customer Due Diligence: AMLD requires CASPs to verify client identities through Know Your Customer (KYC) protocols and to carry out ongoing monitoring of transactions.

- Reporting Obligations: Suspicious activities, such as large or atypical transactions, must be reported to relevant authorities.

- Ongoing Risk Monitoring: AMLD requires CASPs to continuously screen transactions and assess the purpose and nature of business relationships, which is particularly complex in the fast-paced world of digital assets.

MiCA vs. AMLD: Key Differences

How CUBE3 Supports MiCA and AMLD Objectives with Pre-Crime Fraud Prevention

CUBE3.AI takes a distinct pre-crime approach, enabling CASPs to address fraud risks before they become problematic. Here’s how CUBE3 aligns with MiCA’s client protection mandate and AMLD’s anti-fraud measures:

Supporting MiCA’s “Best Interest” Obligation

MiCA requires CASPs to protect clients against known risks, prioritizing their interests in every transaction. CUBE3.AI’s fraud detection services help providers meet the MiCA “best interest” standard by proactively identifying potential fraud risk in transactions, helping safeguard clients from scams and malicious actors.

Enhancing Transparency and Security for MiCA

MiCA’s transparency requirements mean that CASPs must ensure all transactions are traceable and legitimate. CUBE3’s real-time screening and monitoring system supports anti-fraud efforts required by MiCA by providing continuous insights into fraud indicators, helping detect fraudulent patterns and high-risk addresses before funds leave the platform. This proactive monitoring enables CASPs to uphold MiCA’s transparency standards more efficiently.

AMLD and Fraud Prevention: How CUBE3 Helps Meet Due Diligence Standards

Extending Beyond KYC for Enhanced Customer Due Diligence

AMLD requires CASPs to conduct thorough customer due diligence, which includes verifying identities and monitoring ongoing transactions for suspicious activities. While traditional KYC (Know Your Customer) checks verify customer identities, they don’t account for third-party fraud risks in every transaction. CUBE3.AI bridges this gap by offering pre-crime fraud prevention tools, which screen recipient addresses and identify fraud risk in real time. This additional layer of protection goes beyond standard KYC, helping CASPs prevent customer victimization and potential reputational harm.

Ongoing Transaction Monitoring

Regulatory bodies expect crypto providers to report suspicious activities and maintain robust monitoring to combat illicit activity. CUBE3’s platform includes dynamic, AI-driven transaction analysis tailored to uncover emerging fraud schemes and high-risk addresses. By continuously screening transactions and flagging suspicious patterns, CUBE3 assists CASPs in meeting AMLD’s requirements for transaction monitoring, making it easier for teams to report potential threats before they escalate.

Preparing for MiCA’s December 2024 Implementation Date: Actionable Steps for CASPs

The MiCA requirements will come into effect by December 30, 2024, with stablecoin provisions active by June 2024. Here’s what CASPs need to focus on:

- Review Operational Standards: MiCA mandates that CASPs implement robust fraud detection and client protection protocols. This is an ideal time to audit your current processes and adopt pre-crime fraud prevention strategies.

- Strengthen Transparency and Record-Keeping: Start aligning your transaction tracking and reporting systems with MiCA’s transparency requirements. CUBE3’s monitoring tools help maintain transaction records, supporting seamless audit trails.

- Continuous Transaction Screening: AMLD’s ongoing monitoring standards mean CASPs need to watch for unusual activity throughout the client relationship. Integrating fraud detection tools like CUBE3 supports a scalable, automated approach to meet these requirements.

Note: CUBE3 provides pre-crime tools that simplify CASPs’ alignment with MiCA and AMLD without requiring heavy manual intervention. For more information on how CUBE3 can support your team in navigating these regulatory shifts, connect with us to discuss tailored solutions for your needs.

Conclusion: Strengthening Client Trust with Proactive Fraud Prevention

MiCA and AMLD represent a major step toward fostering transparency, security, and accountability in the crypto space. As CASPs take measures to meet these new standards, adopting pre-crime fraud prevention tools is essential—not only to meet regulations but to build a resilient, client-focused platform that stands out in the crypto industry.

Connect with us today to discuss how CUBE3’s pre-crime approach to fraud prevention can support your journey to a more secure, trusted platform for your clients.

Tamás Kelemen

Tamás Kelemen

Silur

Silur

Attila Marosi-Bauer

Attila Marosi-Bauer

Sarunas Matulevicius

Sarunas Matulevicius

Einaras Gravrock

Einaras Gravrock

CUBE3.AI

CUBE3.AI